FAQ’s on Investing in India (Foreign Direct Investment Route) in Electronic System Design & Manufacturing (ESDM) (As on 28 August, 2013) By Invest India

Section I: ESDM sector & General FDI Queries

Q.1 What are the items covered under ESDM sector?

Electronics System Design & Manufacturing sector covers electronic hardware products relating to IT and office automation, telecom, consumer electronics, electronic components, etc., It also includes avionics, solar photovoltaic, strategic electronics, nano electronics, medical electronics, space & defence related items, design related activities like product design, chip designing, VLSI, board design, embedded systems etc. This is not the complete list and any queries related to items falling under the scope of ESDM sector will be decided by the Department of Electronics & Information Technology, Ministry of Communications and Information Technology.

Q.2 What are the objectives of the national policy on electronics?

Government of India has notified the national policy on electronics in 2012. Some of its main objectives include:

- To achieve a turnover of about USD 400 billion by 2020 involving investment of about USD 100 billion and employment to about 28 million people.

- To build on the emerging chip design and embedded software industry.

- To build strong supply chain of raw materials, parts and electronic components.

- To increase exports in ESDM sector from USD 5.5 billion to USD 80 billion by 2020. Etc

- Its strategies include creation of eco-system, promotion of exports, human resource development, maintenance and development of standards, cyber security etc.

The detailed policy be seen from the following link-

(/writereaddata/files/NPE_Notification.pdf)![]() 4.14 MB

4.14 MB

You may also see the presentation on Electronics sector at the following link-

(/writereaddata/files/Esdm_Policy.pdf![]() 927.77 KB)

927.77 KB)

Q.3 Can foreigners invest in ESDM sector in India?

Foreigners can invest in India, either on their own or as a joint venture. 100% FDI is allowed under the automatic route in ESDM sector. However, in case of defence electronics items, FDI up to 26% is allowed under the government approval route and above 26% is allowed through approval of cabinet committee on security (This is allowed on case to case basis; investments should ensure access to modern and ‘state-of-art’ technology in the country). The list of defence related items can be seen from the following link- Defence electronics items are mainly covered in M11 and some other section-

( http://dipp.nic.in/English/Investor/Investers_Gudlines/defenceProducts_L...)![]() 244.53 KB

244.53 KB

- Investment in defence electronics production requires an industrial license and there is a requirement to comply with other conditions laid down in FEMA. The details can be seen from Page No. 5 to 7 of the following link- http://rbidocs.rbi.org.in/rdocs/notification/PDFs/285NTI130913S.pdf

![[PDF]](/sites/all/modules/filesize_filter/icons/application-pdf.png) 281.82 KB)

281.82 KB) - The government approval is also required for foreign investment in existing medical devices manufacturing company (known as brownfield investment)

The investor will need to comply with the reporting requirements of the RBI and comply with all other relevant central & state laws & regulations.

Q.4 Are there any industry associations/agencies in electronics sector to promote development of industry, promote collaborations & facilitate foreign investors?

Yes, India has chambers of commerce and electronics associations which are playing an important role in policy advocacy, promoting industry and helping in match making of foreign companies with Indian counterparts etc.

Key Points of Contact :

- ELECTRONICS INDUSTRY ASSOCIATIONS & CHAMBERS OF COMMERCE: The details of various chambers of commerce and electronics industry associations can be seen from the following link- (/writereaddata/files/List%20of%20Electronics%20Industry%20Associations(3).pdf)

![[PDF]](/sites/all/modules/filesize_filter/icons/application-pdf.png) 76.08 KB

76.08 KB - DEPARTMENT OF ELECTRONICS & INFORMATION TECHNOLOGY (DEITY)

| Name | Designation | Department | Contact Detail |

|---|---|---|---|

| Dr. Ajay Kumar | Additional Secretary | Overall In charge-International Cooperation, Industrial Promotion | ajay[at]deity[dot]gov[dot]in |

| Mr. Deepak Sharma | Scientist E | Industrial Promotion-Electronics & Hardware Manufacturing | dsharma[at]deity[dot]gov[dot]in |

| Scientist F | Cluster Development | ||

| Mr. S.K. Marwah | Scientist F | FAB units | smarwah[at]deity[dot]gov[dot]in |

| Mr. Arun Sachdeva | Scientist G | Standards | asachdeva[at]deity[dot]gov[dot]in |

| Mr. G.V. Rama Raju | Scientist G | Intellectual Property Rights | gramaraju[at]deity[dot]gov[dot]in |

| Mrs. Vandana Srivastava | Additional Director | MSIPS | vandana[dot]srivastava[at]nic[dot]in |

| Shri N. Samaya Balan | Scientist-D | e-Newsletter | ns[dot]balan[at]deity[dot]gov[dot]in |

Contact directory of DeitY is available at

(http://meity.gov.in/content/telephone-directory)

HELP DESK FOR JAPAN & ISRAEL AT DEITY: DeitY has set-up Help Desk for to facilitate investments in ESDM sector for Japan & Israel-The details can be seen from the following link- (http://meity.gov.in/esdm#ita)

| Name | Designation | Department | Contact Detail |

|---|---|---|---|

| Scientist F | Japan Help Desk | ||

| Mr. O.P. Sharma | Scientist F | Israel Help Desk | opsharma[at]deity[dot]gov[dot]in |

Some of the JV opportunities are also available on DeitY website and can be seen from the following link-( http://meity.gov.in/esdm). In this see the section on technology offers for potential manufacturers.

- NODAL OFFICERS FOR ELECTRONICS IN STATE GOVERNMENTS

| Name | Designation | Department | Contact Detail |

|---|---|---|---|

| Indian States | Nodal Officers | Promotion of Electronic Hardware Manufacturing & Applicable Incentives |

- Invest India

Invest India is the national level investment promotion & facilitation agency. The details can be seen from the following link- (http://www.investindia.gov.in/)

| Name | Designation | Contact Detail |

|---|---|---|

| Mr. Dushyant Thakor | General Manager | dushyant[dot]thakor[at]ficci[dot]com |

| Mr. Uday Munjal | Manager - Investment Facilitation | uday[dot]munjal[at]ficci[dot]com |

Queries can also be posted on the website – www.investindia.gov.in Please click on “SEND YOUR QUERY” link on homepage.

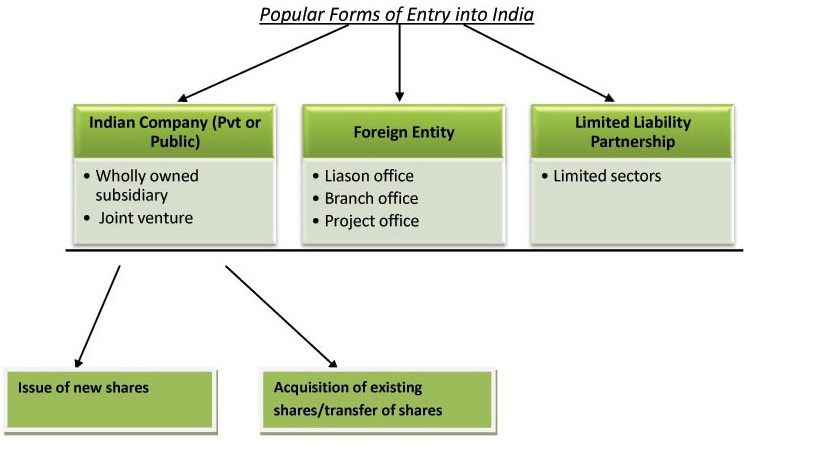

Q.5 As a foreign investor, what kind of a business entity can I set up?

The popular forms of business entity that an investor can set up are given below:

Q.6 Who all can invest in India, i.e. constitution and nature of investing entity?

The investing entity can be an individual, company, foreign institutional investor, foreign venture capital investors, foreign trust, private equity fund, pension/provident fund, sovereign wealth fund, partnership/proprietorship firm, financial institution, non-resident Indians/person of Indian origin, others, etc.

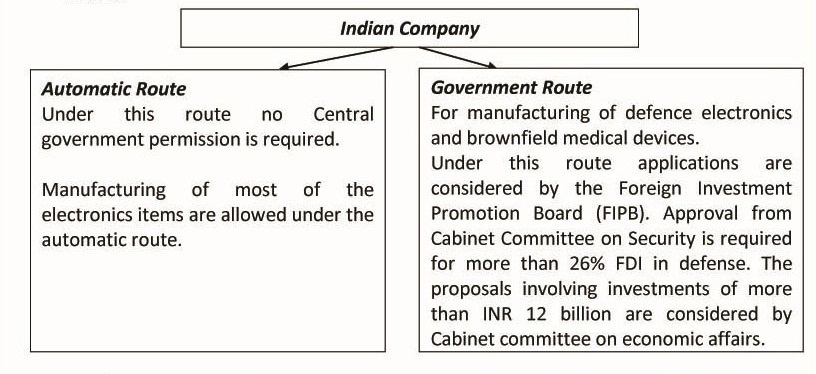

Q.7 How does government allow foreign investment in ESDM sector

Foreign direct investment in an Indian company is considered under two routes:

- The Indian company having received FDI either under the automatic route or the government route is required to comply with provisions of the FDI policy including reporting the FDI to the Reserve Bank of India. The details can be seen from Q.6 of Section I of the following link- (http://www.rbi.org.in/scripts/FAQView.aspx?Id=26)

- Citizens/entities from Pakistan and Bangladesh can invest in an Indian company only through the government route. In addition, an entity/citizen from Pakistan cannot invest in defence, space and atomic energy sectors.

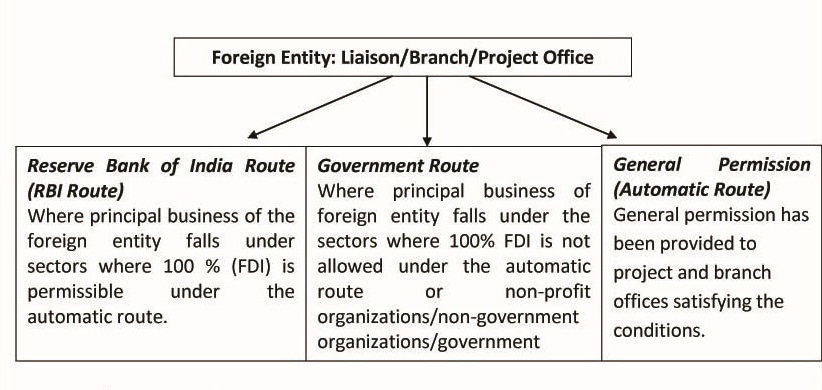

Foreign direct investment in a liaison/branch/project office is considered under the routes:

- Citizens/Entities of Pakistan, Bangladesh, Sri Lanka, Afghanistan, Iran, and China can establish a branch or a liaison office or a project office or any other place of business with the approval of the Reserve Bank of India which takes a decision on the application in consultation with the Government of India.

- General permission (No prior approval required) has been provided to project/branch office which satisfies few conditions and is not from the countries mentioned above or is not under the government route. The details can be seen from point g.1 and c.2 of the following link- (http://www.rbi.org.in/scripts/BS_CircularIndexDisplay.aspx?Id=7312)

Other Forms:

Note:

For all forms of structure: The investor needs to comply with other relevant sectoral & state laws and regulations and also the provisions of Companies Act.

Section II: Queries relating to setting up

We give below rules and regulations relating to setting up of:

1. Company

2. Extension of foreign entity (Liaison/Branch/Project office)

3. Limited Liability Partnership

1. Information on starting a company in India

Q-8 What are the rules and regulations for setting up a company in India?

A foreign corporate can invest and start its operations in India by incorporating a wholly-owned subsidiary under the provisions of Companies Act 1956. It is treated at par with a domestic company and all rules and regulations applicable to an Indian company equally apply to wholly owned subsidiaries.

Another option is to enter into a joint venture with an Indian by forming a company. The management and running of the JV is influenced by the terms stated in the shareholders agreement.

A company set-up in India can either be private limited or public limited.

Public limited company: A public company is defined as one that is not a private company. A subsidiary of Indian public company is also treated as a public company. A public company is required to have a minimum paid-up capital of INR 500,000 with minimum of 7 shareholders and 3 directors.

Private limited company:

The key features of a private limited company in India are as follows:

- It requires a minimum of two shareholders and two directors (both of them can be foreigners).

- It can be formed with a minimum capital of INR 100,000. It can raise loans from banks, financial institutions, etc.

- The number of shareholders cannot exceed 50. It cannot invite the public to subscribe to its shares or debentures.

- It can raise debt in foreign currency in the form of external commercial borrowings.

Generally for foreign investors opening a private limited company is considered as the most popular mode of entry.

Process for setting up a private limited company in India by foreigners: The brief steps required for setting up a company are as follows:

| Phases | Activity | Steps |

|---|---|---|

| I | Obtaining Director’s Identification Number # (DIN) & Digital Signature (DSC) for the proposed directors | a. Obtaining the proof of identity and proof of address from the proposed directors (notarized and apostiled in case of foreign directors) b. Filing of DIN for the proposed directors and obtaining DSC c. At the time of incorporation of company, it is mandatory to submit particulars of registered office. |

| II | Filing of name approval | a. Filing of form for seeking name availability with Registrar of Companies (In case there are corporate shareholders, the company would have to draft a board resolution for seeking name approval. The board resolution and powers to incorporate a company). b. Obtaining name approval |

| III | Filing of charter, location of registered office and details of directors | a. Drafting of charter of company (memorandum and articles of association) and other forms for filing with ROC. b. Sending the subscriber's sheet for execution & authentication, in case of non-.resident shareholders c. Filing of forms with ROC d. Obtaining Certificate of Incorporation |

| IV | Post incorporation formalities | a. Obtaining permanent account number (PAN), opening the bank accounts, tax deduction account number (TAN) for the company. b. Filing with Reserve Bank of India for the subscriber (initial) capital. |

- The forms and other details can be seen from the following link-(http://www.mca.gov.in/MCA21/RegisterNewComp.html). Most of the activities can be done online.

- It is preferable to engage the services of a professional agency in carrying out above activities.

- The process of notarization and apostillment is different for each country. The details of the same for countries signatory to hague convention can be seen from the following link- (http://www.hcch.net/index_en.php?act=text.display&tid=37)

Alternatively the foreign investor can also acquire shares in existing company: Subject to FDI sectoral policy (relating to sectoral caps and entry routes), applicable laws and other conditionality’s including security conditions, non-resident investors can also invest in Indian companies by purchasing/acquiring existing shares from Indian shareholders or from other non-resident shareholders.

- The Form FC-TRS should be submitted to the AD Category-I Bank, within 60 days from the date of receipt of the amount of consideration. The onus of submission of the Form FC-TRS within the given timeframe would be on the transferor/transferee, resident in India.

- The sale consideration in respect of equity instruments purchased by a person resident outside India, remitted into India through normal banking channels, shall be subjected to a Know Your Customer (KYC) check by the remittance receiving AD Category-I bank.

- Prior permission of RBI in certain cases for transfer of capital instruments: (i) Transfer is at a price which falls outside the pricing guidelines specified by the Reserve Bank from time to time and the transaction does not fall under the exception given in para 3.4.5.2. of FDI policy that can be seen from the Page No.22 & 23 of the following link-(

![[PDF]](/sites/all/modules/filesize_filter/icons/application-pdf.png) 0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf

0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf![[PDF]](/sites/all/modules/filesize_filter/icons/application-pdf.png) 0 bytes),(ii) Transfer of capital instruments by the non-resident acquirer involving deferment of payment of the amount of consideration, (iii) Transfer of any capital instrument, by way of gift by a person resident in India to a person resident outside India.

0 bytes),(ii) Transfer of capital instruments by the non-resident acquirer involving deferment of payment of the amount of consideration, (iii) Transfer of any capital instrument, by way of gift by a person resident in India to a person resident outside India. - Indian companies have been granted general permission for conversion of External Commercial Borrowings (ECB) (excluding those deemed as ECB) in convertible foreign currency into equity shares/fully compulsorily and mandatorily convertible preference shares, subject to the conditions and reporting requirements.

- General permission is also available for issue of shares/preference shares against lump sum technical know-how fee, royalty, subject to entry route, sectoral cap and pricing guidelines (as per the provision of para 3.4.2 above) and compliance with applicable tax laws.

- Issue of equity shares under the FDI policy is allowed under the Government route for the following: (i) import of capital goods/ machinery/ equipment (excluding second-hand machinery), subject to compliance with the conditions & (ii) pre-operative/ pre-incorporation expenses (including payments of rent etc.), subject to compliance with the conditions

The details on forms, conditions and guidelines can be seen from the Page No.20 to 29 of the following link- (![]() 0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf

0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf![]() 0 bytes)

0 bytes)

Q.9 What are the instruments allowed for receiving FDI?

The instruments for receiving FDI include: Investments made in equity shares, fully and mandatorily convertible preference shares and fully and mandatorily convertible debentures with the pricing being decided upfront as a figure or based on the formula that is decided upfront. Issue of warrants, partly paid shares etc require prior approval of FIPB.

- Issue of non-convertible, optionally convertible or partially convertible preference shares/debentures needs to comply with the external commercial borrowing (ECB) guidelines of the RBI.

- The inward remittances received by the Indian company vide issuance of DRs and FCCBs are treated as FDI and counted towards FDI.

Q.10 What are the rules relating to pricing of issue of shares?

Price of shares issued to persons resident outside India under the FDI Policy, shall not be less than -

- The price worked out in accordance with the SEBI guidelines, as applicable, where the shares of the company is listed on any recognized stock exchange in India;

- The fair valuation of shares done by a SEBI registered Category - I Merchant Banker or a Chartered Accountant as per the discounted free cash flow method, where the shares of the company is not listed on any recognized stock exchange in India ; and

- The price as applicable to transfer of shares from resident to non-resident as per the pricing guidelines laid down by the Reserve Bank from time to time, where the issue of shares is on preferential allotment.

However, where non-residents (including NRIs) are making investments in an Indian company in compliance with the provisions of the Companies Act, 1956, by way of subscription to its Memorandum of Association, such investments may be made at face value subject to their eligibility to invest under the FDI scheme. The above information can be seen from the Page No.20 of the following link-(![]() 0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf

0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf![]() 0 bytes)

0 bytes)

Q.11 How can a foreign investor transfer funds into an Indian company?

The modes of transfer allowed are: (i) inward remittance through normal banking channels. (ii) debit to NRE/FCNR account of a person concerned and maintained with an Authorized Dealer category-I bank-(AD category-1 bank) (![]() 0 byteshttp://rbidocs.rbi.org.in/rdocs/FEMAMASTER/PDFs/1061.pdf

0 byteshttp://rbidocs.rbi.org.in/rdocs/FEMAMASTER/PDFs/1061.pdf![]() 0 bytes) (iii) conversion of royalty/lump sum/technical knowhow fee due for payment, or conversion of ECB, shall be treated as consideration for issue of shares (iv) conversion of import payables/pre incorporation expenses/share swap can be treated as consideration for issue of shares with the approval of FIPB (v) debit to non-interest bearing escrow account in Indian Rupees in India which is opened with the approval from AD category-I bank and is maintained with the AD category I bank on behalf of residents and non-residents towards payment of share purchase consideration.

0 bytes) (iii) conversion of royalty/lump sum/technical knowhow fee due for payment, or conversion of ECB, shall be treated as consideration for issue of shares (iv) conversion of import payables/pre incorporation expenses/share swap can be treated as consideration for issue of shares with the approval of FIPB (v) debit to non-interest bearing escrow account in Indian Rupees in India which is opened with the approval from AD category-I bank and is maintained with the AD category I bank on behalf of residents and non-residents towards payment of share purchase consideration.

Q.12 What are the reporting requirements of the Reserve Bank of India?

Reporting requirements to the RBI: The Company has to report within 30 days of receiving the application money (inward remittance); intimation is to be made to the concerned regional office of the RBI in respect of the inward bank remittance received in the prescribed form. The company is also required to intimate the RBI within the 30 days of issuing shares to the foreign investor in the prescribed form. The RBI will issue a registration number to the company which is to be mentioned for future correspondence with the RBI, while repatriating funds, etc.

- The capital instruments should be issued within 180 days from the date of receipt of the inward remittance received through normal banking channels including escrow account opened and maintained for the purpose or by debit to the NRE/FCNR (B) account of the non-resident investor. In case, the capital instruments are not issued within 180 days from the date of receipt of the inward remittance or date of debit to the NRE/FCNR (B) account, the amount of consideration so received should be refunded immediately to the non-resident investor by outward remittance through normal banking channels or by credit to the NRE/FCNR (B) account, as the case may be. Non-compliance with the above provision would be reckoned as a contravention under FEMA and would attract penal provisions.

- Apart from the company needs to comply with reporting requirements of Registrars of companies like filling form 2 etc.

- Reporting of transfer of shares between residents and non-residents and vice- versa is to be done in Form FC-TRS within 60 days.

- Details of issue of shares against conversion of ECB have to be reported to the Regional Office concerned of the RBI

- The Indian company issuing ADRs / GDRs has to furnish to the Reserve Bank, full details of such issue in the prescribed form, within 30 days from the date of closing of the issue.

- The details and forms can be seen from the Page No.81 to 119 of the following link- (

![[PDF]](/sites/all/modules/filesize_filter/icons/application-pdf.png) 0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf

0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf![[PDF]](/sites/all/modules/filesize_filter/icons/application-pdf.png) 0 bytes)

0 bytes)

Q.13 Are investments and profits earned in India repatriable?

All foreign investments are freely repatriable (net of applicable taxes) except in cases where: i) the foreign investment is in a sector like defence wherein the foreign investment is subject to a lock-in period (3 years); Further, dividends (net of applicable taxes) declared on foreign investments can be remitted freely through an authorized dealer bank. The details can be seen from the Page No.81-82 of the following link- (![]() 0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf

0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf![]() 0 bytes)

0 bytes)

Q.14 Can a company in India be wound up?

Winding up of a company is a process whereby all the affairs of the company are wound up, all assets sold, liabilities paid off and the balance, if any, is distributed to its shareholders. An administrator, called a liquidator, is appointed; he collects the debts of the company and distributes any surplus among the members. A company may be wound up either by compulsory winding up by court or voluntary winding up by shareholders or creditors. For details, visit the following link- (http://www.mca.gov.in/MCA21/CloseCompany.html)

2. Information on starting a Liaison Office/Branch Office/Project Office in India

Q.15 What are the rules and regulations for the establishment of a Branch office or other place of business in India?

As can be seen from Q.7 the LO/BO/PO can be opened under 3 routes (refer Question 7 of Section I). In case of “RBI route” and “Government route”, the application needs to be submitted to the RBI

The process of opening a LO/BO/PO is as follows: Foreign companies/entities desirous of setting up of Liaison office/Branch office (LO/BO) are required to submit their application in Form FNC along with the documents mentioned therein to Foreign Investment Division, Foreign Exchange Department, Reserve Bank of India, Central Office, Mumbai, through an authorised dealer bank.

For sanctioning of LO/BO, the RBI also considers the track record and net worth of the foreign entities. The details can be seen from page no.2 and 3 of the following link- (![]() 0 byteshttp://rbidocs.rbi.org.in/rdocs/notification/PDFs/07LO280313FL.pdf

0 byteshttp://rbidocs.rbi.org.in/rdocs/notification/PDFs/07LO280313FL.pdf![]() 0 bytes)

0 bytes)

Project Office: The RBI has provided a general permission to foreign companies for establishing POs in India, provided they have secured a contract from an Indian company to execute a project in India and (i) the project is funded directly by inward remittance from abroad; or (ii) the project is funded by a bilateral or multilateral International Financing Agency; or (iii) the project has been cleared by an appropriate authority; or (iv) a company or entity in India awarding the contract has been granted Term Loan by a Public Financial Institution or a bank in India for the project. However, if the above criteria are not met, then such applications need to be forwarded to the RBI.

The RBI has also provided the general permission for opening a BO in SEZs provided such units are functioning in those sectors where 100% FDI is permitted; such units comply with the Part XI of the Company’s Act 1956 and function on a standalone basis.

It should, however be noted that general permission in case of PO/BO is not available to investors from Pakistan, Afghanistan, Bangladesh, Sri Lanka, Iran and China. ?

- General permission means no prior approval is required from RBI subject to prescribed conditions.

Within 30 days of obtaining approval from the RBI, a Form of Establishment (Form No. 44), is required to be filled and filed with the RoC along with the prescribed documents. The LO/BO/PO also needs to comply with Part XI of the company’s act 1956. (Section 591 to 608).

The other rules and regulations relating to LO/BO/PO can be seen from the RBI master circular- (http://www.rbi.org.in/scripts/BS_CircularIndexDisplay.aspx?Id=7312).

Q.16 What are the permissible activities which LO/BO can undertake?

LO/BO can undertake only the activities specified below:

Liaison Office: A LO (also known as Representative Office) can undertake only liaison activities, i.e., it can act as a channel of communication between the head office abroad and parties in India. It is not allowed to undertake any business activity in India and cannot earn any income in India. Expenses of such offices are to be met entirely through inward remittances of foreign exchange from the head office outside India. Permission to set-up a LO in India is initially granted for a period of 3 years and this is likely to be extended from time to time. Upon expiry of the validity period, these entities have to either close down or be converted into a Joint Venture (JV) / Wholly Owned Subsidiary (WOS), in conformity with the extant Foreign Direct Investment policy.

Specified Activities: (i) Representing in India the parent company/group companies; (ii) Promoting export/import from/to India; (iii) Promoting technical/financial collaborations between parent/group companies and companies in India; (iv) Acting as a communication channel between the parent company and Indian companies.

Branch Office: The BO should be engaged in the activity in which the parent company is engaged. Retail trading activities of any nature are not allowed for a BO in India. A BO is, also not allowed to carry out manufacturing (except in an SEZ) or processing activities in India, directly or indirectly. Profits earned by BO are freely remittable from India, subject to payment of applicable taxes

Specified Activities: (i) Export/import of goods; (ii) Rendering professional or consultancy services; (iii) Carrying out research work, in areas in which the parent company is engaged; (iv) Promoting technical or financial collaborations between Indian companies and parent or overseas group company; (v) Representing the parent company in India and acting as buying/selling agent in India; (vi) Rendering services in information technology and development of software in India; (vii) Rendering technical support to the products supplied by parent/group companies; (viii) Foreign airline/shipping company.

Q.17 What are the repatriation rules, reporting requirements, etc., in case of LO/BO/PO?

The details of reporting and repatriation rules for LO/BO/PO are available in the RBI master circular which can be seen from the following link- (http://www.rbi.org.in/scripts/BS_CircularIndexDisplay.aspx?Id=7312)

As per the new circular, the entity establishing LO/BO/PO are also required to report to the Director General of Police of the concerned state government. The details can be seen from the following link- (http://rbi.org.in/Scripts/NotificationUser.aspx?Id=7589&Mode=0)

Q.18 Can LO/BO/PO be closed down?

The winding up procedure for LO/BO/PO are laid down in the RBI guidelines. For details visit the following link- (http://www.rbi.org.in/scripts/BS_CircularIndexDisplay.aspx?Id=7312)

3.Information on other forms of business

Q.19 What is a Limited Liability Partnership?

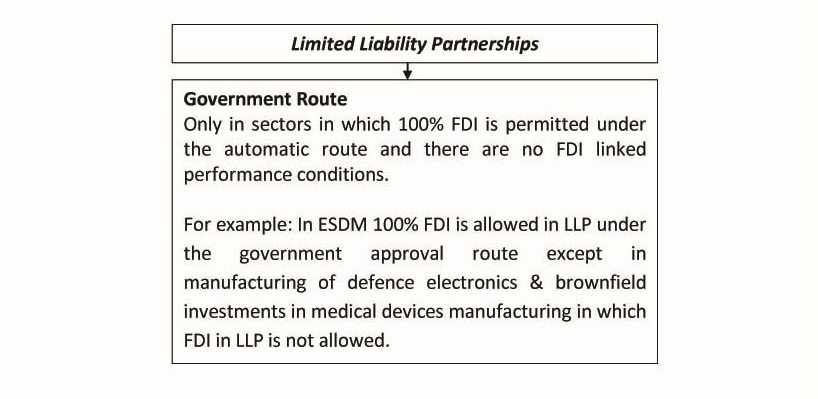

Limited Liability Partnerships: The LLP format allows corporate business entity along with the benefits of limited liability. At the same time, it allows the members the flexibility of organizing their internal structure as a partnership based on mutually-agreed terms. Like a private limited company, LLP is a body corporate having a distinct legal entity. The LLPs are governed by the LLP Act 2008. However, the RBI has still not notified the LLP structure in FEMA.

FDI will be allowed through the government approval route, only in LLPs operating in sectors/activities where 100% FDI is allowed through the automatic route and sectors are not subject to additional conditions.

The other details can be seen from page numbers 16 and 17 on the following link-(![]() 0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf

0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf![]() 0 bytes).

0 bytes).

The LLP act and rules can be seen from the following link- (http://www.mca.gov.in/LLP/).

The details of registering a New LLP and reporting requirements can be seen from the following links-

(http://www.mca.gov.in/LLP/RegisterNewComp.html),

(http://www.mca.gov.in/LLP/CARFiling.html)

Q.20 Is it possible to dissolve the LLP in India?

The details of LLP closure can be seen from the following link- (http://www.mca.gov.in/LLP/CloseCompany.html).

Section III: Queries relating to business compliances

Q.21 What are other main registrations required by a company or BO/PO/LO in India?

The following registrations need to be obtained:

1) Permanent Account Number (PAN)

2) Tax Deduction Account Number (TAN)

3) Service Tax

4) Value Added Tax

5) Excise Registration

6) Foreign Regional Registration Officer (if required)

7) Import Export Code (if required)

8) Shops and Commercial Establishment Act (if required)

Q.22 What are the other auditing and annual reporting requirements to be followed in case of companies & BO/PO/LO operating in India?

We list the most essential compliances below:

Accounting: All businesses in India need to maintain accounting records, which meet the generally-accepted accounting principles. In India, a business entity is free to choose its accounting year. However, under income tax laws, it is mandatory to close books of accounts on a financial year basis from April 1 to March 31 of next year.

Employment Payroll: Business is needed to draft appropriate employment contracts keeping in view the income tax laws and employment regulations.

Employment Payroll: Business is needed to draft appropriate employment contracts keeping in view the income tax laws and employment regulations.

Tax Audit: LO is not required to do a tax audit. Companies are also required to undergo a VAT audit.

Annual return on Foreign Liabilities and Assets-Refer to Page Nos. 103 to 110 of the following link- (![]() 0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf

0 byteshttp://dipp.nic.in/English/Policies/FDI_Circular_01_2013.pdf![]() 0 bytes)

0 bytes)

Every company is required to file the following documents with the ROC:

1) Annual Return

2) Balance Sheet

3) Compliance Certificate

Other compliances:(http://www.mca.gov.in/MCA21/CARFiling.html).

Board meeting: Quarterly

Annual general meeting: Within 180 days of start of financial year

Annual return with ROC: Within 60 days of holding the AGM

Corporate tax return: September 30 and November 30;

Tax audit report: September 30 and November 30;

Transfer pricing report: November 30;

TDS returns: Quarterly;

Other reports, submissions, payments like excise, service tax returns etc: monthly

- The filling requirements under the Companies Act can be seen from the following link-(http://www.mca.gov.in/MCA21/CARFiling.html)

- The reporting requirements of BO/PO/LO can be seen from the following link- (http://www.rbi.org.in/scripts/BS_CircularIndexDisplay.aspx?Id=7312)

- The reporting, auditing requirements of Limited Liability Partnerships can be seen from the following FAQ available on the following link- (http://www.mca.gov.in/LLP/faq_llp_basic_concept.html)

Comparative summary of entry operations in India:

| S. No. | Particulars | Liaison Office | Project Office/Branch Office | Company | Limited Liability Partnership |

|---|---|---|---|---|---|

| 1 | Legal status | Represents the parent company | Extension of parent company | Independent legal status | Independent legal status |

| 2 | Setting up requirements | Prioir approval of RBI required | Prior approval of RBI required for BO (other than undertaking manufacturing and service activities in SEZ's), Prior approval not required to set up PO if certain conditions are fulfilled | If activities/sector fall under the ambit of the automatic route, no prior approval required but only post-facto filings to be undertaken with the RBI. In other cases, GoI/FIPB approval required and thereafter post-facto filings required to be undertaken with RBI | Foreign investments allowed in sectors, which are under 100% automatic route with prior GOI/FIPB approval. The sectors should also not be subject to performance linked conditions |

| 3 | Permitted activities | Only liaison/representation/communication role permitted. No commercial or business activities allowed to be undertaken | Activities listed/permitted by RBI allowed to be undertaken, manufacturing and processing activities (except in SEZ units) not permitted for BO. PO is permitted to undertake only specific activities in relation and incidental to the execution of the project | Any activity specified in the memorandum of association of the company. Wide range of activities permitted, subject to FDI guidelines | LLP should be engaged in sectors/activities for which 100% FDI is allowed without any approal. LLP's with foreign investment will not be elgible to make any downstream investments |

| 4 | Funding of local operations | Local expenses to be met out of inward remittances received from abroad from the head office through normal banking channels | Local expenses to met through inward remittances from head office or from earnings from permitted operations | Funding to be through equity or other forms of permitted capital infusion or borrowings (local as well as oerseas as per prescribed norms) or internal accruals. | Contribution in the capital of the LLP should be through inward remittance or by debit to NRE/FCNR account of the designated partner. LLP's are not eligible to raise ECB |

| 5 | Limitation of liability | Parent company liable for acts of LO | Parent company liable for acts of BO/PO | Liability limited to the extent of equity participation in the Indian company | Liability of the partners is limited to their agreed contribution to the LLP except in case of fraud, wrongful act, etc |

| 6 | Compliance requirements under companies act | Registration and periodical filing of accounts/other documents | Registration and periodical filing of accounts/other documents | Significantly high statutory compliance and filing requirements | Registration with ROC required. Filing annual accounts and submitting annual statement on solvency |

| S. No. | Particulars | Liaison Office | Project Office/Branch Office | Company | Limited Liability Partnership |

| 7 | Compliance requirements under foreign exchange management regulations | Required to file an annual activity certificate (from auditors in India with RBI). In case of multiple LO's the nodal office could file a combined annual activity certificate with respect to all its offices in India | Required to file an annual activity certificate (from auditors in India with RBI) In case of multiple BO's the nodal office could file a combined annual activity certificate in respect of its offices in India | Required to file periodic and annual filings relating to foreign liabilities and assets, reciept of capital and issue of shares to foreign investors | No filing requirements prescribed as of now |

| 8 | Compliance requirements under the Income tax act | Since LO is not permitted to undertake any business activity in India, it is typically not subject to tax in India. Howeer, LO is required to undertake annual compliance by filing annual information in the precribed form | Liable to be taxed on income earned at the rate applicable to foreign corporations. 40% plus surcharge and education cess. In case above tax is not applicable than MAT is considered to be applicable to BO/PO at rate of 18.5% plus surcharge and education cess of its book profits. No further tax on repatriation of profits, which are permissible in both cases. Indian transfer pricing regulations are applicable | Liable to be taxed on global income at 30% plus surcharge and education cess on a net income basis. In case above tax is not applicable than Subsidiary company liable to MAT of its book profits. Dividend declared freely remittable but subject to distribution tax of 15% plus surcharge and edu. cess on dividends, pursuant to which dividend is tax free for all shareholders.Distribution tax to be paid only on amount of dividend. | Liable to be taxed on global income at 30% plus education cess on net income basis. In case above tax is not applicable then LLP liable to MAT at the rate of 18.5% plus cess of its book profits no DDT leived on profit dustribution and Indian transfer pricing regulations are applicable |

| <9 | Permanent establishment (PE) | LO's generally do not constitute PE under DTAA due to limited scope of actvities in India. However, if the activities of the LO go beyond the realm of preparatory or auxiliary character as provided for in the DTAA, a PE/taxable presence is likely to be constituted | Generally constituting a PE and a taxable presence under DTAA and domestic IT proisions | An independent taxable entity and not a PE of the foreign company | An independent taxable entity; however, whether interest in LLP results in PE for a foreign partner, is still an ambiguous position under LLP |

| S. No. | Particulars | Liaison Office | Project Office/Branch Office | Company | Limited Liability Partnership |

| 10 | Repatriation of funds on ongoing basis | Typically the LO is not permitted to undertake any business activity in India; as such,there may not be any repatriations from the LO. However, in case of closure of the LO, any surplus money may be repatriated with RBI approval | Approval not required for remittance of post-tax profits to the HO outside India, subject to filing of requisite documents to the RBI | Subsidiary does not require any approval for remittance of post-tax profits; dividends declared will be subject of distribution tax | LLP does not rquire any approval for remittance of post tax profits |

| 11 | Exit mechanism | Prioir approval of RBI, ROC and income tax authorities | Prioir approval of RBI, ROC and income tax authorities | Exit can be through sale of shares or winding up or liquidation | Foreign partner permitted to transfer its stake in LLP and can also dissolve the LLP |

Office space: At the time of incorporation of company, it is mandatory to submit particulars of registered office. Business entities are free to buy or lease the office space.

Section IV: Queries relating to starting a manufacturing unit

Q.23 What are the different steps for starting a manufacturing unit?

Setting up a company or any other form of business: The business structure can be a company, a branch office in an SEZ, or the LLP. The details about each form are given in Section I and Section II.

Project Approval: Preparing the detailed project report and getting an approval from the concerned state government department.

Approvals/Registration/Filing information for setting up a project

| Procedure | Applicability | Authority |

| SSI Registration | Small Scale Units | District Industries Centre (DIC) of the district where the unit is to be located |

| Industrial Entrepreneur’s Memorandum (IEM) | The small and medium enterprises as classified are required to file EM Part-I for starting an industrial project. On completion of the project, the entrepreneur is required to file Entrepreneurs Memorandum (EM) Part-II. | District Industries Centre/ Industries Commissionerate |

| Filing Industrial Entrepreneur’s Memorandum (IEM) (IEM) | Industries exceeding Investment of INR 5 Cr (which are exempt from the provisions of industrial licensing) | Secretariat for Industrial Assistance, Ministry of Commerce and Industry, Government of India |

| Letter of Intent (LOI) | Industries where licensing is required | Secretariat for Industrial Assistance, Ministry of Commerce and Industry, Government of India, New Delhi |

Under the Micro, Small and Medium Enterprises Development Act 2006 by Government of India, Micro, Small and Medium Enterprises are classified as under:

| Manufacturing Sector | |

| Enterprises | Investment in plant & machinery |

| Micro Enterprises | Does not exceed INR twenty five lakh |

| Small Enterprises | More than INR twenty five lakh rupees but does not exceed INR five crore |

| Medium Enterprises | More than INR five crore but does not exceed INR ten crore |

| Service Sector | |

| Enterprises | Investment in equipments |

| Micro Enterprises | Does not exceed INR ten lakh |

| Small Enterprises | More than INR ten lakh but does not exceed INR two crore |

| Medium Enterprises | More than INR two crore but does not exceed INR five core |

Industrial License (If required): No industrial license is required for setting up electronics manufacturing unit. However if the company is engaged in defence electronics items manufacturing than there is requirement of an industrial license-The details where industrial licensing is required can be seen from the following links-

(https://www.ebiz.gov.in/industriallicense),

(https://www.ebiz.gov.in/EbizWeb/page/ebiz/portal/faqdetails&ServiceCode=...)

Factory Land/Office Space: While setting up a factory, acquiring an industrial land with a clear title is the key step. State governments have empowered industrial development corporations (IDC’s) which develop land for industrial use. These IDC’s require that an application may be submitted specifying the desired area size along with the proposed business plan. Applications are reviewed and merits considered before land is allotted.

The land for factory can be acquired in various areas like

- Special economic zones

- Electronic manufacturing clusters

- National investment & manufacturing zones

- Export oriented zones/Software technology parks/Electronic hardware technology parks

- Industrial zones

- Industrial areas &

- Private land

- Invest India the national level investment promotion & facilitation agency provides facilitation services for obtaining information on land, arranging location visits for investors and connecting them to state IDC’s/SEZ/NIMZ’s etc. (http://www.investindia.gov.in/)

- The list of various states & UT’s can be seen from the following link- (http://www.ibef.org/economy/directory/indian-states-directories)

- The list of various state investment promotion agencies can be seen from the following link- (http://www.ibef.org/economy/directory/state-investment-promotion-agencies)

- The general information on various state governments can be seen from the presentations available on each state government on the following link-(http://www.ibef.org/states.aspx). In this download the state report.

Factory Construction: Once the land is indentified and before commencing construction, the company has to submit a factory plan which will normally require an approval by the concerned industrial corporation. Each state industrial corporation has its own building bye-laws. In addition, there are other clearances or approvals. Once construction is complete, an industrial corporation normally requires the company to obtain the completion certificate.

Other state/central level regulations: Yes, there will be additional state level regulations/registrations that will be required, the details of which can be seen from Q.24 below:

Human Resource Hiring and Management: It includes complying with various labour laws. The details of which can be obtained from the labour department of the state government. Some of the important laws are Industrials disputes Act, 1947, Trade unions Act, Payment of bonus Act, 1965, Payment of gratuity act, 1972, Minimum wages Act, 1948, Payment of wages Act, 1936, Factories Act, 1948, etc,.

Key Labor Requirements:

| 1 | Maximum hours worked by employees | 48 hours per week |

| 2 | Number of Indian employees which trigger employer obligation to provide employees state insurance | 10 |

| 3 | Number of Indian emloyees which triggers employer obligation under Provident Fund Scheme, Bonus Act | 20 |

| 4 | Number of years of continuous service which makes an employee eligible for gratuity | 5 years |

| 5 | Minimum bonus to be paid to an employee drawing a basic wage of INR 10000 or less | 8.33% |

| 6 | Prohibited age of employing young children in factories | 14 years |

| 7 | In case of retrenchment due to/or closure, number of employees which trigger employer obligation to seek prior government approval | 100 |

| 8 | On retrenchment/lay off/closure | Compensation is payable to employee |

* Link to Ministry of labour-(http://labour.nic.in/).

Q.24 Are there any other state/Central level regulations?

Yes, there are many other state-level regulations like getting approvals from the fire department, the pollution control board, and environment ministry in some cases. The rules and regulations are different in each state.

The Government of India is soon going to launch an initiative for all business interactions with the government under one single window known as “eBiz” ( https://www.ebiz.gov.in/homebook).License & permit wizard of this eBiz project gives an indication of the license and permits required for setting up the project. The details can be seen from following link-(https://www.ebiz.gov.in/servicesbook). The link gives only the indicative list of approvals required for 5 areas.

“Single window” clearance facilities are available in various states to simplify the approval process for new ventures. For example in National investment and manufacturing zones, Special purpose vehicles (SPV) will provide the facilitation services of getting some of the approvals. Details can be seen from the following link-

( http://dipp.nic.in/English/policies/National_Manufacturing_Policy_25October2011.pdf ![]() 0 bytes)

0 bytes)

We provide below, some of the clearances that may be required.

| S.No. | Details | Registration/Approving Authority |

|---|---|---|

| 1 | Building Plan | State Land Authority |

| 2 | Factory Drawing, Application for Factory License | Chief Inspector of Factories |

| 3 | Contractual Labor (if employed) | Registration with Labor Commissioner under Contract Labor Act, 1970 |

| 4 | Consent to Establish, consent to operate, pollution control certificate, generator installation | State Pollution Control Board |

| 5 | Importer Exporter Code Number | DGFT |

| 6 | Factory employing more than 20 Employees | Registration of Provident Fund |

| 7 | Factory employing more than 10 Employees | Registration with ESI |

| 8 | Central Excise Registration | Central Board of Excise & Customs |

| 9 | LPG/Petrol Installed In Factory | Petroleum & Explosive Safety Organization |

| 10 | Power & Water Connection | State municipal authority |

| 11 | Factory Occupation Certificate | Inspector of factories of respective states |

- The above is an indicative list only.

Q.25 What are the financing or funding options available to carry a business in India?

Various forms of sources are available like:

- Capital Markets:Listing of shares by going public (Private limited company will have to convert into public company) The conditions relating to listing can be seen from the following link-

(http://www.nseindia.com/getting_listed/content/eligibility_criteria.htm ) - Loans from special financial institutions like

IDBI (http://www.idbi.com/index.asp)

EXIM (http://www.eximin.net/) &

SIDBI (http://www.sidbi.in/) - Non-banking finance companies. The list of NBFC can be seen from the following link-( http://www.rbi.org.in/scripts/BS_NBFCList.aspx)

- External commercial borrowing (foreign sources). The rules relating to ECB’s and Trade credit can be seen from the following link-(http://rbidocs.rbi.org.in/rdocs/notification/PDFs/12MCECB290613.pdf

![[PDF]](/sites/all/modules/filesize_filter/icons/application-pdf.png) 0 bytes)

0 bytes) - Retained profits or reinvestment of profits

- Bank credit in the form of loans, cash credit, overdraft and discounting of bills. The list of banks can be seen from the financial intermediaries section of the following link(http://www.rbi.org.in/scripts/sitemap.aspx) The current base lending rates of banks are b/w 9.80-10.5%

- Customer advance, accounts receivable financing, Installment credit & trade credit

Section V: Type of manufacturing locations and Electronic Manufacturing Clusters

Q.26 What are Special Economic Zones and Free Trade Warehousing Zones?

- Special Economic Zones (SEZ)/Free Trading & Warehousing Zones (FTWZ): The SEZ scheme seeks to provide an internationally-competitive and free environment for exports. These zones are designated duty-free enclaves and are treated like foreign territories for the purpose of trade operations, duties and tariffs. The SEZ policy offers several fiscal and regulatory incentives to units operating within these zones. The details on SEZ/FTWZ like rules, areas, act, etc can be seen from the following link-(http://www.sezindia.nic.in/index.asp)

- Units in SEZ or FTWZ shall be a positive net foreign exchange earner (NFE). NFE shall be calculated cumulatively for a period of five years from the commencement of production.

- The details of operational SEZ and FTWZ can be seen from the following link-( http://www.sezindia.nic.in/about-osi.asp)

- A branch office can undertake manufacturing activities in an SEZ unit.

Various kinds of incentives are available for a unit set-up in SEZ is as follows:

- Duty free import/domestic procurement of goods for development, operation and maintenance of SEZ units. (Raw materials, capital goods, consumables, components & spares for authorized operations)

- 100% income tax exemption on export income SEZ units under Section 10AA of the Income Tax Act for the first 5 years, 50% for the next 5 years thereafter and 50% of the ploughed-back export profit for the following 5 years.

- Exemption from Central Sales Tax, exemption from service tax. Exemption from state sales tax and other levies as extended by the respective state governments.

- Single-window clearance for central and state level approvals.It should, however, be noted that a minimum alternate tax @18.5% and DDT are applicable in case of units operating in SEZs and other export-oriented parks.

Q.27 What are Export Oriented Units (EOU’s), Export Technology Hardware Parks (ETHP) & Software Technology Parks (STP’s)?

- Units can be set up as an Export Oriented Unit or in Export Technology Hardware Park or Software Technology Park. Units undertaking exports of their entire production of goods and services, except permissible sales in DTA, may be set up as an EOU/EHTP or STP

- Income tax holiday of 10 years for the competing policies like STPI/EHTP/BTP etc are already over. (Ended on 31 March 2011).

- Rest of the incentives is similar to those available for SEZ units given in Q.26 above.

Q.28 What is national manufacturing policy and national investment and manufacturing zones (NIMZs)?

The National manufacturing policy, approved on October 25, 2011, is the first of its kind for the manufacturing sector as it tries to address some critical constraints for Indian manufacturing sector in the area of regulations, infrastructure, skill development, technology, availability of finance, exit mechanism etc. The policy envisages the creation of National Investment and Manufacturing Zones (NIMZs). NIMZs will be large areas (minimum 5000 hectares) of developed land, with requisite eco-system for promoting world class manufacturing activity. NIMZ will be a self-governing and autonomous body.

There will not be any fiscal incentives like available for SEZs but some of the incentives include:

- Relief from capital gains tax on sale of plant and machinery of a unit located in NIMZ will be granted in case of re-investment of sale consideration within a period of 3 years for purchase of new plant and machinery in any other unit located in the same NIMZ or another NIMZ

- The transfer of assets belonging to a firm which has been declared sick will be facilitated by the SPV of the concerned NIMZ

- The policy provides for specific incentives for technology development and there is a special focus on green/clean technology.

- Special focus on skills development

- Special benefits/measures for SMEs in national manufacturing policy.

The details can be seen from the following link-

( http://dipp.nic.in/English/Policies/National_Manufacturing_Policy_25October2011.pdf ![]() 0 bytes)

0 bytes)

Q.29 What are Electronic Manufacturing Clusters?

Electronic Manufacturing Clusters: There are two types of EMC’s:

A) Brownfield electronic manufacturing clusters are those existing areas which are notified by DeitY. For a unit to be eligible for Modified Special Incentive Package Scheme (M-SIPS) it should be located within the brownfield EMC. DeitY notifies brownfield EMC considering geographical area, infrastructure availability etc. So it is possible to notify new brownfield EMC if it is already not notified.

B) The brownfield EMC’s already notified can be seen from the following link-(http://meity.gov.in/esdm). The focus is on upgrading infrastructure and providing common facilities for ESDM units.

C) Greenfield electronic manufacturing clusters are new industrial areas which are being promoted for attracting investments in electronics. The list of zones thus far approved by DeitY can be seen from the following link-( /writereaddata/files/EMC_Appraisal.pdf![]() 47.05 KB)

47.05 KB)

The list of nodal officer to be contacted for EMC can be seen from the following link-

( /writereaddata/files/Nodal-officer_EMC.pdf![]() 100.13 KB )

100.13 KB )

Q.30 What is the mode of implementing the scheme of EMCs?

The scheme is implemented through the special purpose vehicle (SPV) which will carry out the business of developing, operating and maintaining the infrastructure, amenities and other common facilities created in EMCs.

Q.31 Who will be the chief promoter?

Chief promoter for the purpose of the scheme is a legal entity which initiates the proposal for a project in a brownfield or greenfield EMC and takes such steps as are necessary for getting the project approved under the scheme, getting the SPV formed and entrusting the project to an SPV in accordance with the scheme and guidelines. A chief promoter may be an individual, registered company or society, industry association, financial institution, R&D institution, state or local government or their agencies or unit/units within an EMC.

Q.32 What are the financial assistance provided for EMC’s?

Brownfield EMC: The assistance will be restricted to 75% of project cost subject to ceiling of INR 0.5 Billion. The remaining project cost shall be financed by other stakeholders of the EMC with a minimum industry contribution of 15% of the project cost.

Greenfield EMC: The assistance will be restricted to 50% of the project cost subject to ceiling of INR 0.5 Billion for every 100 acres of land. The remaining project cost shall be financed by other stakeholders of EMC with a minimum industry contribution of 25% of the project cost.

The administrative expenses would be restricted to 3% of the central assistance in the project. Expenses towards preparation of detailed project report would also be considered a part of project cost.

Q.33 What is the land ownership in EMC?

The scheme supports any of the following different models of land ownership for an EMC:

- The land for the EMC & Project is owned by the applicant.

- The land for the project is owned by the applicant but remaining land is not owned by the applicant. In such cases, it is for the applicant to demonstrate his ability to meet the terms of scheme and guidelines with the involvement of the constituents units in the EMC.

Q.34 How to get land for Greenfield EMC?

The land for EMC or the project may be acquired by the applicant through one of the following modes:

- Outright purchase or long lease from private parties

- Sale (outright or conditional), or long lease of land by central or state or local government or its agency

- Centre or state or local government or its agency participating as equity partner in the SPV wherein the cost of land is provided as its share.

Q.35 Does national manufacturing policy applies to EMC?

Yes, national manufacturing policy shall be applicable to Greenfield EMC which would fall within the NIMZs. A collection of EMCs, geographically outside the proposed NIMZs may be treated as a single virtual NIMZ for governance purposes.

Q.36 What are the dates for applicability of EMC scheme?

The scheme will be open for applications for 5 years from the date of notification (November 07, 2012) further period of 5 years shall be available for disbursement of funds to approved applicants. The applications received under the scheme will be appraised on an ongoing basis.

Note:

- The details of electronic manufacturing cluster scheme can be seen from the following link-

( /writereaddata/files/Scan_EMC-Notification-Gazette.pdf![[PDF]](/sites/all/modules/filesize_filter/icons/application-pdf.png) 2.53 MB)

2.53 MB) - The detailed guidelines for electronic manufacturing clusters can be seen from the following link-

( /writereaddata/files/EMC-Guidlines_Final.pdf![[PDF]](/sites/all/modules/filesize_filter/icons/application-pdf.png) 6.89 MB)

6.89 MB) - The benefits of SEZ are not applicable to unit operating in EMC unless and until EMC is classified as SEZ.

Section VI: Taxation Aspects

Q.37 What are various forms of taxation in India?

Indirect taxes:

Indirect taxes are of the following types:

1) Customs duty: Payable on imports into India

2) Excise duty: Payable on manufacturing in India

3) Service Tax: Payable on rendering of services

4) Central sales tax/value added tax: Tax on value addition at each level of the distribution network. Tax levied interstate is known as Central Sales Tax.

5) R&D cess: It is a cess on all payments made by an industrial concern for imported technology.

6) Other indirect taxes include: Stamp duty, octroi, property tax etc.

• Most of the taxes are cenvatable that is it can be squared off against paid taxes.

• Government of India is actively considering Goods & Services Tax which will subsume several of above indirect taxes.

• India is signatory to ITA-1 which provides for ZERO duty rates on import of specified items. The ITA-1 agreement can be seen from the following link-

/writereaddata/files/Information%20Technology%20Agreement%20(1996)%20(54%20KB).pdf)

| Indirect Taxes | |||

| S.No. | Type of Tax | Company | BO/LO/PO |

|---|---|---|---|

| 7 | Excise Duties-Levied on manufacture of goods in India. However, may be recovered by vendors for procurements. | Peak Rate is 12.36% | Peak Rate is 12.36% |

| 8 | Service Tax | Peak Rate is 12.36%. | Peak Rate is 12.36%. |

| 9 | Import Duties/Customs Duty (India is signatory to ITA-1 which provides for ZERO basic custom duty rate on import of specified items) | The peak rate of basic custom duty is 10% (this rate can vary depending upon the item specification). The above rate is basic rate of duty which is further increased by countervailing duty (12%), additional CVD (4%), and education cess @3% of taxes) etc. General peak effective rate – 28.8% Imports of specified capital goods is allowed at zero basic custom duty rate Import of certain input items used in manufacturing of electronic items under ITA-1 are allowed at ZERO basic custom duty rate |

The peak rate of basic custom duty is 10% (this rate can vary depending upon the item specification).

The above rate is basic rate of duty which is further increased by countervailing duty (12%), additional CVD (4%), and education cess @3% of taxes) etc. General peak effective rate – 28.8% Imports of specified capital goods is allowed at zero basic custom duty rate Import of certain input items used in manufacturing of electronic items under ITA-1 are allowed at ZERO basic custom duty rate |

| 10 | Central Sales Tax (Interstate sales) | Rate is 2% or local Value Added Tax rate applicable in the State from where goods are sold within India | Rate is 2% or local Value Added Tax rate applicable in the State from where goods are sold within India |

• Taxes at State Government Level:

| S.No. | Type of Tax | Company | BO/LO/PO |

|---|---|---|---|

| 1 | Value Added Tax | Different Rate of taxes on different goods generally 1%, 5% and 12.5% | Different Rate of taxes on different goods generally 1%, 5% and 12.5% |

| 2 | Entry Tax/Octroi (If applicable) | Certain states impose entry tax/octroi in specific goods | Certain states impose entry tax/octroi in specific goods |

| 3 | Property Tax | Property tax/real estate tax is payable as per local municipal laws on commercial and residential property owned. | Property tax/real estate tax is payable as per local municipal laws on commercial and residential property owned. |

| 4 | Profession Tax | Certain states in India levy a profession tax on employees | Certain states in India levy a profession tax on employees |

• Most of the indirect taxes are cenvatable that is it available for set-off

• The exact rate of import duty can be calculated from the calculator available at the following link-( https://www.icegate.gov.in/Webappl/)

• The basic rate of duty for project imports is 7.5%

Direct taxes:

Direct taxes are of following types:

Corporate tax (Taxes on net income), minimum alternate tax (in case company gets exemption on corporate tax), tax on royalty/fee for technical services, dividend distribution tax, withholding tax, withholding tax on interest etc.

Carry forward of losses are allowed for 8 years and companies are allowed to have depreciation and amortization allowances.

Transfer Pricing: Any international transaction between two or more associated enterprise must be at arm’s length price. • India also has advance pricing arrangements option which help in avoiding into entering into any dispute with tax authorities. • The FAQ on APA’s can be seen from the following link- ( www.itatonline.org/info/?dl_id=1215 ) • The government of India has notified safe harbor rules in case of transfer pricing the detailed rules can be seen from the following link-

Minimum Alternate Tax: Indian tax law requires MAT to be paid by corporations on the basis of profits disclosed in their financial statements in cases where the tax payable according to the regular tax provisions is less than 18.5% of their book profits (plus surcharge and education cess). However tax credit (in case MAT paid is more than tax payable as per normal provisions of the ACT) is allowed to be carried forward for 10 years.

Withholding Tax: Businesses need to withhold tax on specified payments viz salary, contractual, brokerage, commission, professional fee etc.

• Taxes at Central Government Level: (Direct Taxes)

| S.No. | Type of Tax | Company | BO/LO/PO |

|---|---|---|---|

| 1 | Tax on Profits (Income Tax) -Financial Year 2013-14 (From April 2013 to March 2014) | If income is less than INR 10 million than rate is 30.9%, If income is between INR 10 million to INR 100 million then rate is 32.44% and if income exceeds INR 100 million then tax rate is 33.99% | If Income is less than INR 10 million than rate is 41.2%, If income is between INR 10 million to INR 100 million then rate is 42.02% and if income exceeds INR 100 million then tax rate is 43.26% |

| 2 | Personal Income Tax | As per slabs of income | As per slabs of income |

| 3 | Tax on distributed profits | Rate is 16.99%-on distribution of dividends by the Indian company | No tax on distributed profits |

| 4 | Wealth Tax | A company is liable to pay tax on certain assets such as motor car, etc in excess of INR 3 million in India @ 1% | A project Office is liable to pay tax on certain assets such as motor car, etc in excess of INR 3 million in India @ 1% |

| 5 | Social Security Benefits | Every establishment in India, employing 20 or more persons is required to register with the social security authorities unless they are an exempt establishment. For Indian passport holders, social security contribution is optional for employees if their salary exceeds INR 6,500 per month. | Every establishment in India, employing 20 or more persons is required to register with the social security authorities unless they are an exempt establishment. For Indian passport holders, social security contribution is optional for employees if their salary exceeds INR 6,500 per month. |

| a) Employee Contribution | 12% of salary | 12% of salary | |

| b) Employer Contribution | 12% of salary | 12% of salary | |

| 6 | International Worker | International worker may get exemption from social security regulations, if there is SSA with the country, and the worker is contributing in his/her own country and for defined terms and conditions in relevant SSA. | International worker may get exemption of social security regulations if there is SSA with the country, and the worker is contributing in his/her own country and for defined terms and conditions in relevant SSA. |

In case of LLP the tax on income are as follows:

• Business income: 30% plus surcharge and education cess

• Alternate Minimum Tax: The concept to AMT is similar to the Minimum Alternate Tax (MAT), as applicable to the Companies but since there is no concept of book profits in case of LLP, the LLP’s will be liable to pay AMT on their adjusted total income (equivalent to adjusted taxable income). Similar to Company, LLP paying AMT can claim its credit for 10 assessment years. But as opposed to Company, LLP will not be liable to pay AMT on those income, which are exempt under provisions of Income Tax like long term capital gain under section 10 (38) and income from dividend under section 10 (34) etc

• There is no dividend distribution tax on LLP’s.

Royalty Rates

The rates of royalty country wise can be seen from the following link-( http://law.incometaxindia.gov.in/DIT/File_opener.aspx?fn=http://law.incometaxindia.gov.in/Directtaxlaws/dtrr2005/R10.htm )

Q.38 Does India has double taxation avoidance agreements and free trade agreements?

India has Double Taxation Avoidance Agreements signed with various countries; the list of countries can be seen from the following link- (http://law.incometaxindia.gov.in/DIT/intDtaa.aspx). Benefits of DTAA:

• Lower Withholding Taxes (Tax Deduction at Source)

• Complete Exemption of Income from Taxes

• Underlying Tax Credit

• Tax Sparing Credits

• DTAA provides lower rate or exemption for taxes on capital gains (gains made by selling the business unit)

• It also provides taxability of business profits if the company has permanent establishment in India. A building site or construction, installation or assembly project constitutes a permanent establishment only if it continues for a period of more than 183 days in any fiscal year.

India also has free trade agreements providing for concessional import duties. The details of FTA’s and other agreements can be seen from the following link- ( http://commerce.nic.in/trade/international_ta.asp?id=2&trade=i )

Q.39 What are the reporting requirements related to taxes?

Tax liability in India can either be discharged through the advance tax mechanism or the tax withholding mechanism. Under the advance tax mechanism, one estimates the entire year’s tax liability and deposits through three annual installments, i.e. September 30 (30%), December 15 (30%) and March 15 (40%). An LO is not required to pay corporation or withholding tax as there is no income.

Q.40 What are the various types of Visas?

Government of India issues the following visas: Business Visa, Conference Visa, Diplomatic Visa, Employment Visa, Emergency Visa, Entry Visa, Journalist Visa, Medical Visa, Missionaries Visa, and permit to re-enter within 2 months, Research Visa, Student Visa, Tourist Visa, and Transit Visa. Please follow the link for details on Visa Provision and supporting documents. (http://indianvisaonline.gov.in/visa/). Preferable visas from an industry point of view are business visa, employment visa and conference visa.

· FAQs relating to work-related visas (business/employment) issued by India can be seen from the following link- ·

Q.41 Is there any act to regulate competition in India?

Competition Act: The government of India enacted a modern competition law in the form of Competition Act, 2002 and established the Competition Commission of India to carry out the objectives of the Act. The details can be seen from the following link- (http://www.cci.gov.in/images/media/competition_act/act2002.pdf?phpMyAdmin=QuqXb-8V2yTtoq617iR6-k2VA8d )

Q.42 Can companies in India enter into foreign technology agreements?

Technology Agreements: Foreign investment in technology agreements effecting payments for royalty, lumpsum fee for transfer of technology and payments for use of trademark/brand name are allowed under the automatic route, i.e., without any approval of the Government of India. Foreign technology includes technical know-how, design, drawing, engineering service and royalty. Use of foreign brand names/trademarks is permitted for sale of goods in India.

Section VIII: Information on various types of Incentives

Q.43 What are the various types of incentives available?

There are various types of incentives available from Central and state government departments for establishing a manufacturing unit. The incentives differ among the states and registration will be required to obtain various kinds of incentives.

Central Government Incentives:

Incentives on exports: The foreign trade policy provides various kinds of incentives for export of goods and services. The various types of incentives are as follows:

• Duty exemption/remission scheme:

Advance Authorization: Duty free imports of inputs allowed for exports provided minimum 15% value addition is achieved. The scheme also requires import to be completed in 12 months and exports within 18 months.

Annual Advance Authorization: It is available only to exporters with at least 2 years of exports. The entitlement will be equivalent to 300% of the FOB value or INR 10 million whichever is more. The authorization will be valid for 12 months.

Duty Free Import Authorization: Under this exporters are allowed to import inputs free of basic customs and or additional/SAD duty. Scheme covers only products under standard inputs output norms. It also required minimum value addition of 20%.

Duty Drawback: Duty Drawback is the rebate of duty chargeable on imported material or excisable material used in the manufacturing of goods in and is exported. The exporter may claim drawback or refund of excise and customs duties being paid by his suppliers. Drawback Schedule covers now about 4600 products.

• Export promotion capital goods scheme-Under the scheme import of capital goods at a zero basic custom duty is allowed for export purposes. The capital goods for pre/post production stage also permitted. The exports to be effected equivalent to 6 times the duty saved on capital goods. Exports to be completed in 6 years.

• Focus Market Scheme: The basic objective is to offset high freight cost and other externalities to select international market. The benefit of 3% transferable duty free credit entitlement for specified countries. The special focus markets to get 4% benefits.

• Focus Product Scheme: The basic objective is to encourage products with high export intensity/employment. Benefit of 2 or 5% transferable duty free credit entitlement for specified products. Certain products to get 2% bonus benefits.

• Market Linked Focus Product Scheme: The basic objective is to incentivize exports with high employment intensity in rural and semi-urban areas. The benefit of 2% transferable duty free credit entitlement for specified products.

• The list of electronic items covered under FPS & MLFPS can be seen from the following link- (/writereaddata/files/Electronic%20items%20notified%20by%20DGFT-July%202013%20.pdf ![]() 361.98 KB)

361.98 KB)

• Market Access Initiatives: Under MAI scheme, financial assistance is provided for export promotion activities on focus country, focus product basis. Financial assistance is available for Export Promotion Councils (EPCs), Industry and Trade Associations (ITAs), Agencies of State Government, Indian Commercial Missions (ICMs) abroad and other national level institutions/eligible entities as may be notified.

• Incremental exports incentivisation scheme: A duty credit scrip @ 2% on the incremental growth (achieved by the IEC holder) during the current year is given. (Incremental growth shall be in respect of each exporter (IEC holder) without any scope for combining the exports for Group Company). The scheme is region specific and covers exports to USA, Europe and Asia. In addition, 53 countries in Latin America and Africa

• The details of various exports incentives schemes and procedures can be seen from the Foreign trade policy and procedures available on the following link-( http://dgft.gov.in/exim/2000/download-ftp1213.htm )

• For the incentives and facilities offered to units in SEZs please refer Q.26

• North Eastern States: There is an incentive scheme of central government for undertaking established in north eastern states. The details can be seen from the following link- (http://dipp.nic.in/English/Schemes/ner.aspx)

• R&D concessions: There are some deduction incentives for research and development expenditure.

• Investment allowance (additional depreciation) at the rate of 15 percent to manufacturing companies that invest more than INR 1 billion in plant and machinery during the period 1.4.2013 to 31.3.2015.

• Incentives available for unit in NIMZ please refer to Q.28

• Apart from above additional incentives are given under various schemes in ESDM sector and by the state governments. The details of which can be seen from Q.44 to 60

Q.44 Are there any incentives or schemes for electronics system design and manufacturing sector unit?

Yes, Department of Electronics and Information Technology has launched the following schemes to promote domestic manufacturing of electronics items:

· Modified special incentive package scheme (M-SIPS) provides for subsidy of 25% of capital expenditure in non-SEZs (and 20% in SEZs) for investments made for 10 years. In addition, reimbursement of central taxes and duties on specified projects is also provided for period of 10 years. The support is available for any stage of value-addition of the electronic product. Incentives start only when initial capital expenditure cross minimum threshold and thereafter it is given on annual capital expenditure. · Preference to domestically manufactured electronic goods in government procurement is provided.

Q.45 When was the M-SIPS launched and what is the duration of the scheme?

MSIPS was launched on 27 July 2012 and it will be applicable for 3 years from this date.

Q.46 Can existing units claim benefits under M-SIPS?

The MSIPS will be applicable to investments in new ESDM units and expansion of capacity/modernization and diversification of existing ESDM units. ESDM unit shall mean a unit engaged in design and manufacturing of the electronics and nano-electronics and their accessories. It includes all stages of value addition and also includes electronics manufacturing services.

Expansion of existing unit would mean increase in the value of fixed capital investment in plant & machinery of an ESDM unit by not less than 25% for the purpose of expansion of capacity/modernization and diversification.

Q.47 What are the items and investment thresholds under M-SIPS?

The list of items eligible for incentives and investment threshold can be seen from the following link-